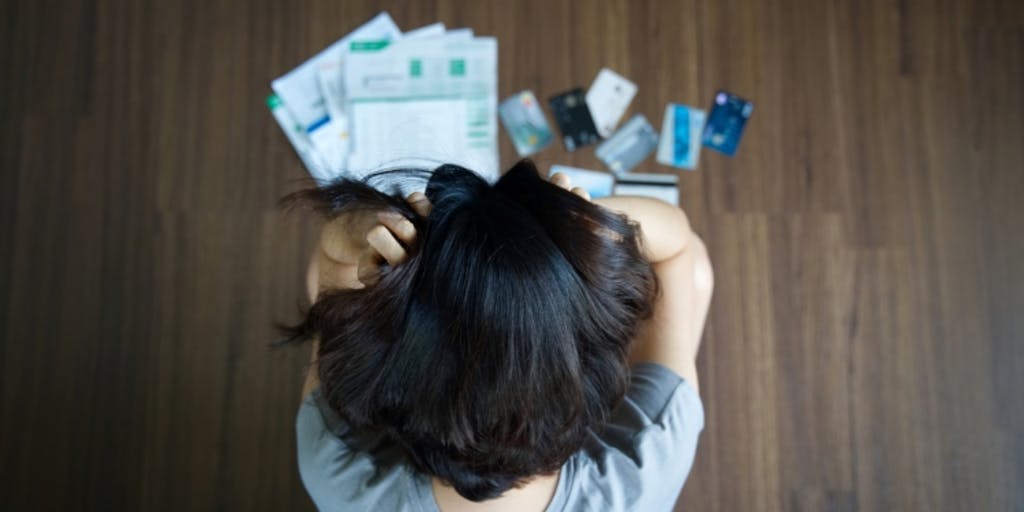

For many people, purchasing using credit cards has become an indispensable part of everyday life. However, it often happens that we get carried away and exceed the limits that we are not in a position to pay off later. Then, the only solution is debt consolidation.

However, the question arises whether and how a credit card can be used after debt consolidation? Here is the answer.

Credit Card Debt Has Become A Part Of Our Everyday Life

A credit card is the easiest way to get a loan. Most banks offer it as part of a current account package. You can use that small piece of payment plastic anywhere, anytime – even when you don’t have the money. That luxury of spending money that is not yours can easily become a habit – and for many of us, it turns into a trap from which it is difficult to release. Then we fall into debts from which it is sometimes hard to get out without debt consolidation.

Most debtors consider debt consolidation the only real option to solve the problems you have fallen into by spending too much on your credit card. This fact is not so strange when you consider that the average household in the USA has between 15,000 – 20,000 $ in debt on credit cards. Therefore, for many people, debt consolidation is the only way to release and repay their debt on a credit card.

You Have Decided To Consolidate Your Debts

The moment you decided to consolidate your credit card debt – you made the right decision. This way, you will be able to consolidate all your card debts into a single one. What definitely benefits you is the fact that when you combine all the debts – you no longer have a problem with different interest rates.

Namely, then all debts are calculated at a single interest rate, which is usually lower than the one you paid on credit cards until then. Also, repayment terms are more flexible and longer, so your monthly debts are smaller.

Specifically, your monthly debts will be in balance and level with your monthly cash inflows. It is this fact that contributes to easier repayment of your debt. However, many users are not clear about what happens after debt consolidation. How to use credit cards after debt consolidation? Here are some things you can do to make yourself easier with these things.

Overcome Challenges

When you manage to pay off your debts through debt consolidation, you will feel relief. However, the path to the end of repayment is neither easy nor short. Many people succumb to that path, losing motivation. With a lack of motivation, you get to the point where you lose the dynamics in the payment of monthly installments again – and you can end up at the very beginning, which is certainly not good. Then individuals rely on loans from private companies, such as Credit9, but it is a double-edged sword.

You have to be very careful and look at Credit9 reviews because it happens that many of the companies do not give favorable loan terms. So it is better to think carefully before you decide on this option. One thing is for sure – when you gradually go through the debt consolidation process, you will be able to bring your card balance to zero.

Do Not Cancel Credit Cards After Repayment

Most credit card debtors find themselves in trouble primarily because the cards are easy to obtain – so it’s easy to lose sight of regular payments or overdrafts. However, after using a loan to consolidate debt when they bring credit card debts to zero – many people make the mistake of canceling credit cards. While most people do this completely instinctively, it’s still not the best move – so don’t do it that way.

In case you have repaid your credit card debts and canceled the cards, your credit limit will be significantly reduced, and your credit rating will not get better. On the contrary, this will lower your credit score, which will prevent you from buying some things you may have planned in the future – such as a car, a house, or the like. You need to keep in mind that you never know if you will need a loan and for what reason. So don’t do things that could limit you in doing so.

Track Amounts On Your Credit Cards

Once you have repaid your debts with the help of debt consolidation, you still have credit cards at your disposal. We have already said that you should not cancel them because your credit rating largely depends on using credit cards. However, this doesn’t mean that you need to fall into the trap of excessive spending again. This means that you must take care not to exceed the allowed limits – and that you regularly repay everything you have from credit card debt.

Therefore, you must carefully monitor the status of your spending on credit cards and manage your accounts and budget wisely. Never spend more money than you make, because that is the only way you will be able to return to healthy financial habits that will not lead you to further debts.

Do You Start Over After Debt Repayment? Set Your Budget Wisely!

After debt consolidation, you practically start from scratch again. That means you have to manage your finances wisely. A prerequisite for this – is smart budgeting. This is not difficult to do, of course, if you have a rational way of thinking and no unrealistic expectations. Simply, calculate all your expenses for one month together with the income you have at your disposal.

It happens that the amounts of monthly bills are higher than your monthly income – and it was the original reason why you accumulated credit card debt in the first place. If this is the case, be extra careful when making new payments, because you don’t want such a situation to happen to you again. Instead, consider ways you can reduce your spending – and save some money so you don’t have to exceed your credit card limits again.

Here’s Another Plus Tip In The End

If you have several credit cards, now is the time to check the conditions and put everything on paper. Write down how much debt you have on which card – as well as how much interest you pay. You should simply stop using credit cards whose use is the most expensive. Instead of that, focus on repaying them, and use cards that give you more favorable terms.